AgFunder Report: Agrifood-tech Investment Plummets to Six-Year Low Amidst Changing Landscape

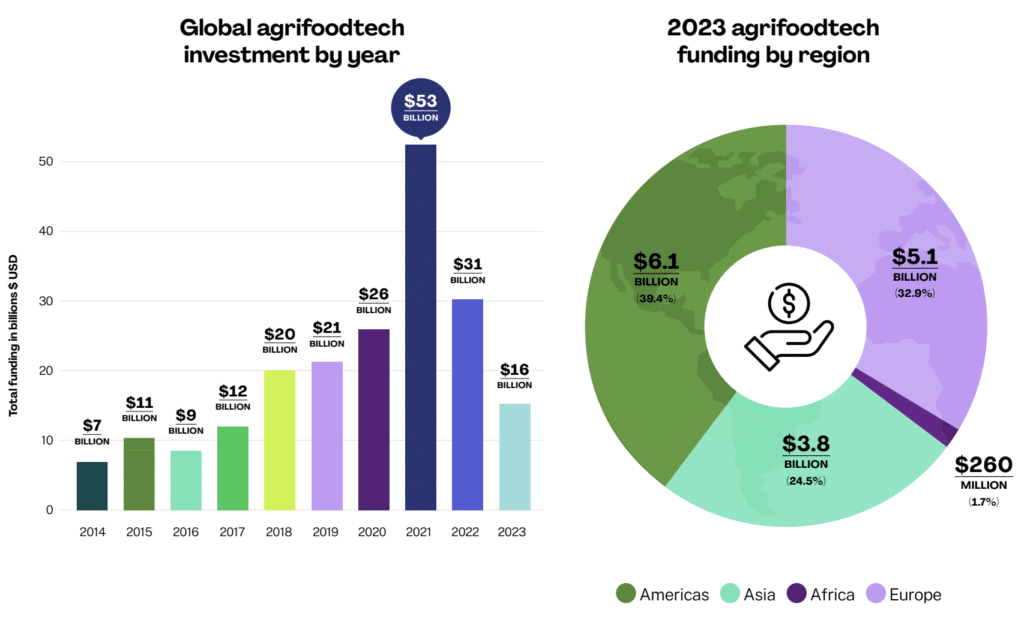

The landscape of agrifoodtech investment has experienced a seismic shift, with funding hitting its lowest point in six years, according to the latest report by AgFunder. The Global AgriFoodTech Investment 2024 report reveals a staggering decline of nearly 50% from 2022 to 2023, marking a significant departure from the bullish trends witnessed in previous years.

This downturn is not isolated but reflects broader trends within the venture capital markets. AgFunder’s main data partner, Crunchbase, notes a 35% year-over-year drop across all venture capital sectors. However, the decline in agrifoodtech investment has been even more pronounced, signaling a notable retreat from this once-thriving sector.

In 2023, agrifoodtech accounted for just 5.5% of VC dollars across all sectors, a notable decrease from 6.7% in 2022 and 7.6% in 2021. This shift underscores a broader trend of generalist investors shying away from the agrifood-tech sector, which had previously seen substantial investments, particularly in categories such as alternative protein and vertical farming.

In concrete figures, agrifoodtech startups globally raised $15.6 billion in 2023, down a staggering 49.2% from the previous year’s $30.5 billion. This decline affected almost all categories, except for Bioenergy & Biomaterials and Farm Robotics, Mechanization & Equipment.

Bioenergy & Biomaterials emerged as the largest category in terms of funding, securing $3 billion in 2023, marking a 20% increase from the previous year. Similarly, Investment in Farm Robotics, Mechanization & Equipment continued its upward trajectory, growing by 9% year-over-year to reach $760 million.

Interestingly, funding to upstream startups, those operating directly on farms or in food production, accounted for 62% of overall investment in 2023, a significant increase from previous years.

Geographically, no region escaped the downturn unscathed. While Europe saw a relatively modest 14% decline in dollar funding, both Africa and Asia experienced significant setbacks. African investment levels remained higher than 2021 but failed to match previous figures, while Asia struggled to recover its pre-Covid totals.

Don’t miss out! Subscribe to our newsletter for the latest content straight to your inbox, or register for FREE to gain full access.

In the United States, agrifoodtech funding plummeted, with the country’s share dropping to just over 30% of global funding, a notable decrease from its usual 40% share. Deal count also saw a substantial decline, reflecting smaller rounds with few exceptions.

Emerging markets witnessed a redistribution of funding, with China and India losing market share to other nations.

The report has limited information about Latin America as a stand-alone region, and groups North and South America as one for some of its statistics. However, there are some notable mentions of debt rounds within the agri-fintech space, including Brazil’s Nagro ($40M) and Cultivo’s ($14.4M) as well as Mexico’s Verqor ($35M). It also recognized Brazil based SuperBAC’s $63M round within the Top 20 and 7th place within the Ag-Biotech sector.

For founders working in the space, the report also includes some insights from investors that are worth keeping in mind, including these predictions about 2024:

- “Investments made during 2024 will provide solid investment returns given [that] the quality of businesses still standing will be higher on average (than in 2021, for example), and given that valuations will have further corrected from their highs of the past years.”

– Costa Yiannoulis, Synthesis Capital - “More corporate investment activity as VCs continue to have difficulty raising funds.”

– Erin VanLanduit, Cargill - “It’s back to basics, which is fundamentally healthy. Profit over growth. Investors want to understand the pathway to profitability and an exit. I hope to see more climate tech funding going into ag/food.”

– Daniel Skaven Ruben, FoodTech Weekly/Solvable Syndicate

Predictions about valuations and market corrections, opinions as to why the sector hasn’t seen more exits in the past 10 years, and many more details can be found in the report. Download a copy here.

Responses